To deal with financial matters after your death, you need to name an executor in your will. That means that your agent can only make financial decisions for you while you are alive and incapacitated. The financial power of attorney is automatically extinguished upon your death. This means that the power is not granted to your agent until you are incapacitated (and certified as such by a doctor). If you do not want this, you should create a "springing" financial power of attorney. Generally, it goes into effect the second you sign it. So decide whether you want to make the power durable or not. This means though, that if you are then incapacitated again, that person is no longer your financial agent since the power was given but then extinguished by your recovery. However, if you recover, that power is now gone. The best way to illustrate this is by example.įor example, if you grant it but don't make it durable, then when you are incapacitated, your agent will have the power to make financial decisions as you would expect. Durability simply means whether the power is always there, but it has significant consequences that may not be apparent. The first distinction to keep in mind when you are granting financial power of attorney is whether or not to make it "durable".

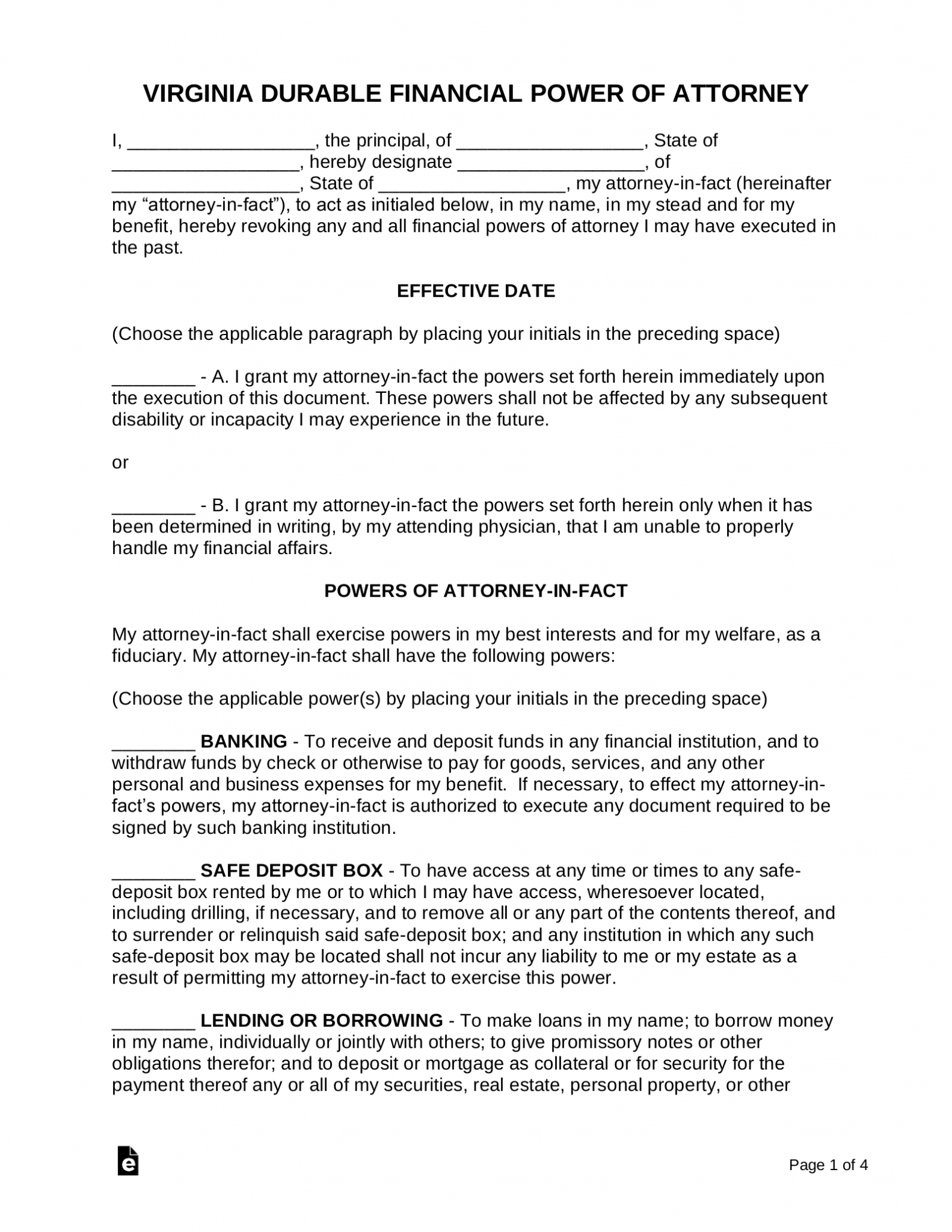

Finally, many banks have their own forms, and while not strictly necessary, it will make the process much easier if your bank knows who your financial agent is. If your agent will have to deal with real estate assets, some states require you to put the document on file in the local land records office. Generally, the document must be signed, witnessed, and notarized. We offer state-specific, easy-to-use forms that have been created and approved by attorneys. Most states don't require that you use these forms, but it is always a good idea to do so. Most states have simple forms to fill out to make someone your financial agent. Creating a Durable Financial Power of Attorney If your financial and medical agent isn't the same person or disagree on medical care, the financial agent can make receiving medical care difficult. Often, people also name a medical agent who can make medical decisions for them. One area of potential conflict to keep in mind is paying for medical expenses. Your agent cannot do whatever they want to do but must act in your best interests. When deciding whether to set limits, consider the kind of tasks your agent will likely be asked to perform: You can set the limits of your agent's power, granting as much or as little power as you think is appropriate. This person's official name depends on the state you live in but is often referred to as your agent or as an attorney-in-fact. More precisely, it grants someone legal authority to act on your behalf for financial issues.

0 kommentar(er)

0 kommentar(er)